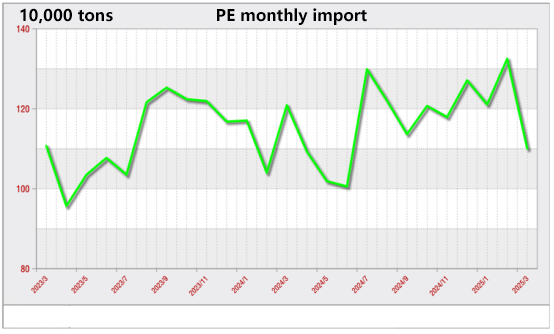

According to customs statistics, China’s polyethylene (PE) imports sharply declined to 1.101 million tons in March 2025, a decrease of 16.92% month-on-month and 8.94% year-on-year. Among them, the import volume for LDPE (Tariff Code 39011000) was approximately 270,000 tons, down 18.43% month-on-month but up 8.26% year-on-year; HDPE (Tariff Code 39012000) imports were about 437,000 tons, a decrease of 17.16% month-on-month and 12.84% year-on-year; and LLDPE (Tariff Code 39014020) imports reached about 394,000 tons, down 7.27% month-on-month and 14.03% year-on-year.

The main reasons can be summarized as follows:

1.Reduction in Overseas Supply: Some plastic production facilities overseas underwent maintenance during the first quarter, and additionally, production rates in the Middle East and Southeast Asia dropped due to Ramadan, further constraining export capacity.

2.Release of Domestic Capacity: New production capacities, such as those from Baofeng in Inner Mongolia, came online in March, leading to a PE output of 2.7486 million tons domestically—an increase of 7.05% month-on-month—and a reduced reliance on imports.

3.Lack of Competitiveness: Domestic PE prices continued to be under pressure and declined, causing international resources to preferentially flow to regions with higher prices.

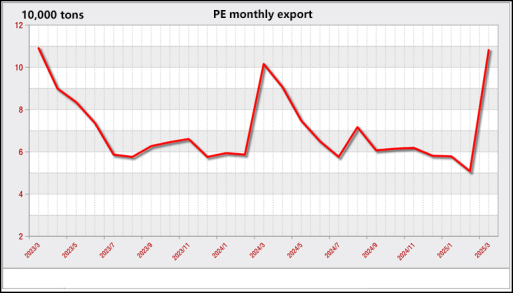

In contrast to the imports, polyethylene exports surged in March, reaching 108,200 tons, nearly matching the high point of 109,100 tons in March 2023. This figure represents an 86.87% increase month-on-month and a 6.50% increase year-on-year. Breaking this down by product, LDPE exports were approximately 26,900 tons, an increase of 94.93% month-on-month and 17.98% year-on-year; HDPE exports were 62,400 tons, up 83.53% month-on-month and 17.29% year-on-year; while LLDPE exports were about 18,900 tons, an increase of 87.13% month-on-month but a decrease of 26.1% year-on-year.

The three key drivers of this export surge are:

1.Chinese New Year Timing: The low base effect from the timing of the Spring Festival, which usually has a negative impact on exports lasting about 30 days. The Spring Festival in 2024 was on February 10, which affected the early March performance due to shutdowns, resulting in a lower base. In contrast, the 2025 Spring Festival was earlier, allowing for recovery in operations by March, thus exports rebounded.

2.Strong Resilience in External Demand: There remains robust demand from foreign markets.

3.Phase of 'Export Rush': U.S. tariffs of 145% on imports from China were set to take effect in April, prompting companies to rush shipments in March to avoid cost increases, contributing to a “rush to export” effect.

Looking ahead, in April 2025, as the demand for agricultural films and greenhouse films is expected to seasonally decline, domestic market demand for imports may weaken. Coupled with the release of new domestic capacities (such as Baofeng's third line in Inner Mongolia and new installations from Shandong Xinshi), increased domestic supply may partially replace import demand. Furthermore, rising costs due to tariffs may lead businesses to seek alternative sources from regions such as the Middle East and Canada. Therefore, a month-on-month decline in PE import volume is expected in April. On the export side, overseas demand may weaken, the arbitrage window is closing, and currency fluctuation risks may also contribute to a slight month-on-month decrease in PE exports in April.